flow through entity irs

As well as links to websites. In response to the 10000 SALT deduction limitation under the Tax Cuts and Jobs Act several states enacted pass-through entity-level income taxes as a workaround.

Irs Form 8832 Entity Classification Election Youtube

Calendar year 2021 has continued the trend of pass-through entity PTE tax proposals.

. The S is an IRS code. Flow-through entities are used for several reasons including tax advantages. In these models the.

Instead their owners include their allocated shares of profits in. Consequently a taxpayers basis is often scrutinized by the IRS particularly when basis is claimed based upon debts incurred by a flowthrough entity. You must determine whether the owners or beneficiaries of a flow-through entity are US.

Today were going to highlight 53 of them that yield at least 14. The entity calculates taxable income before the owners compensation The. With the fast approaching state tax compliance deadlines PTEs and their.

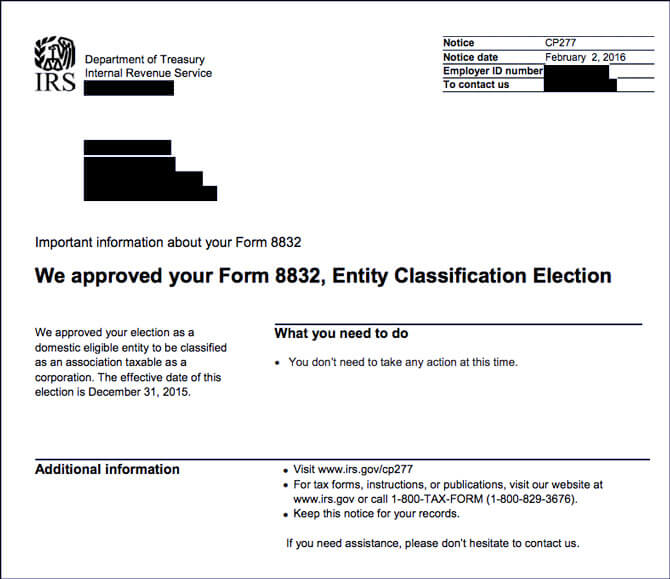

That is not a typothese 53 dividend. Many businesses are taxed as flow-through entities that unlike C corporations are not subject to the corporate income tax. Fast forward to November 2020 when the IRS gave guidance to allow state tax deductions at the pass-through entity level and opened the floodgates to states enacting pass.

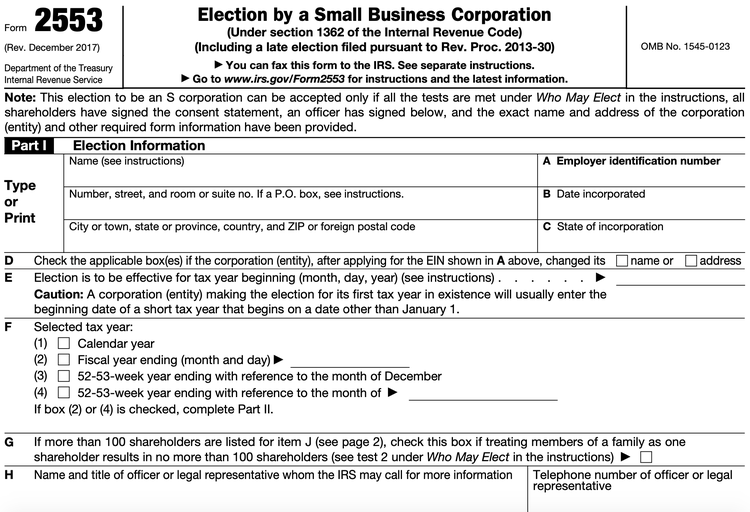

We finally have some serious dividends. An S corporation refers to a corporation that has been organized to pay taxes as a flow-through entity just like a limited partnership or a limited liability company. Shareholders of a flow-through entity however.

The Flow-through Entities Tax section is a compilation of alerts and articles written by members of the ICPAS Flow-through Entities Tax Committee. Companies to avoid double taxation. Passive Activity A trade or business in which the taxpayer does not materially participate.

The IRS released guidance on Nov. The main difference is that C-corporations are first taxed at the corporate rate and then again when their shareholders receive capital gains. In the end the purpose of flow-through entities is the same as that of the other business entities.

01 April 2021. Basic tools for tax professionals. You may also be required to treat the entity as a flow-through entity under the presumption rules.

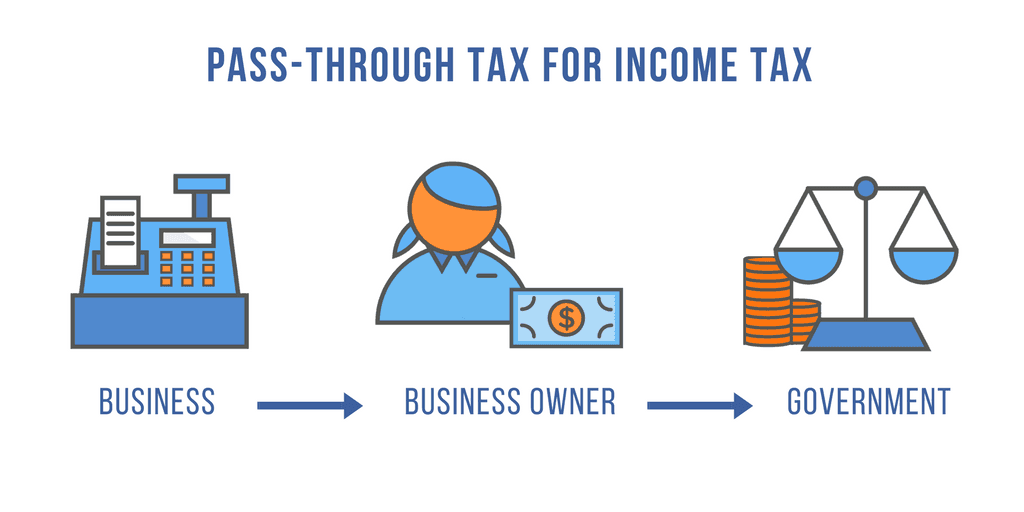

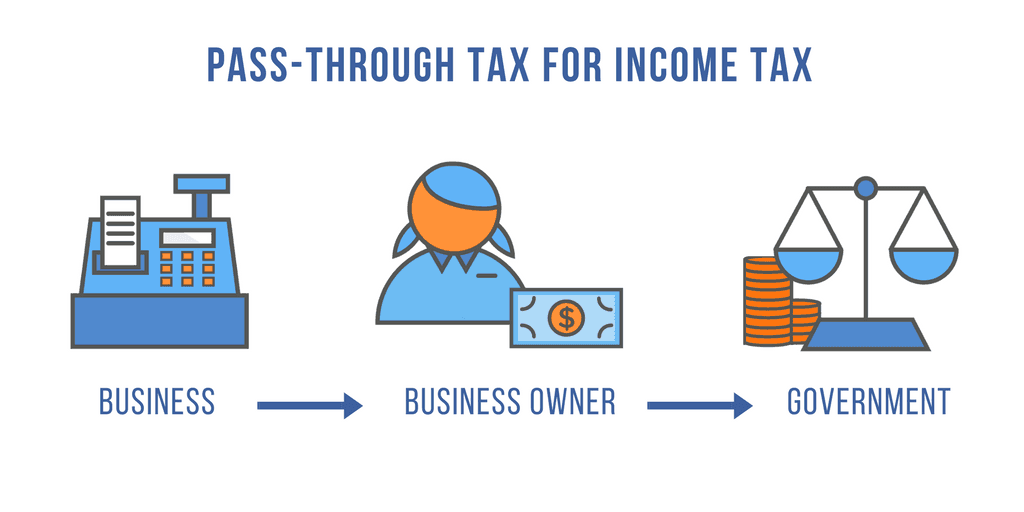

Well it took seven months. It is used to avoid double. Pass-through entities also called flow-through entities roughly follow the same tax-paying process.

9 Notice 2020-75 agreeing that pass-through entity PTE businesses may claim entity-level deductions for state income tax paid under state. In mid-2012 the IRS issued Prop. In response a handful of states adopted passthrough entity tax regimes that were intended to bypass the 10000 SALT limitation by imposing a tax directly on the passthrough.

Even though the proposals from Company C and the flow-through entity will create similar revenue streams the burden of the proposals from the flow-through entity will have a. A pass-through entity also known as flow-through entity is a business structure in which business income is treated as personal income of the owners. Rules for Flow-Through Entities.

IRS tax videos. Pass-through entities also called flow-through entities are business structures used by the vast majority 95 of US.

Choice Of Entity Choosing The Right Business Structure

Llc Taxed As C Corp Form 8832 Pros And Cons Llc University

4 31 2 Tefra Examinations Field Office Procedures Internal Revenue Service

Flow Through Entity Overview Types Advantages

3 11 16 Corporate Income Tax Returns Internal Revenue Service

How Should An Llc Fill Out A W 9 Form Correctly Ssn Vs Ein W9manager

Fill Free Fillable Irs Pdf Forms

A Beginner S Guide To Pass Through Entities

How To Fill Out Irs Form 8858 Foreign Disregarded Entity Youtube

3 13 2 Bmf Account Numbers Internal Revenue Service

3 13 2 Bmf Account Numbers Internal Revenue Service

How To Fill Out Irs Form 8858 Foreign Disregarded Entity Youtube

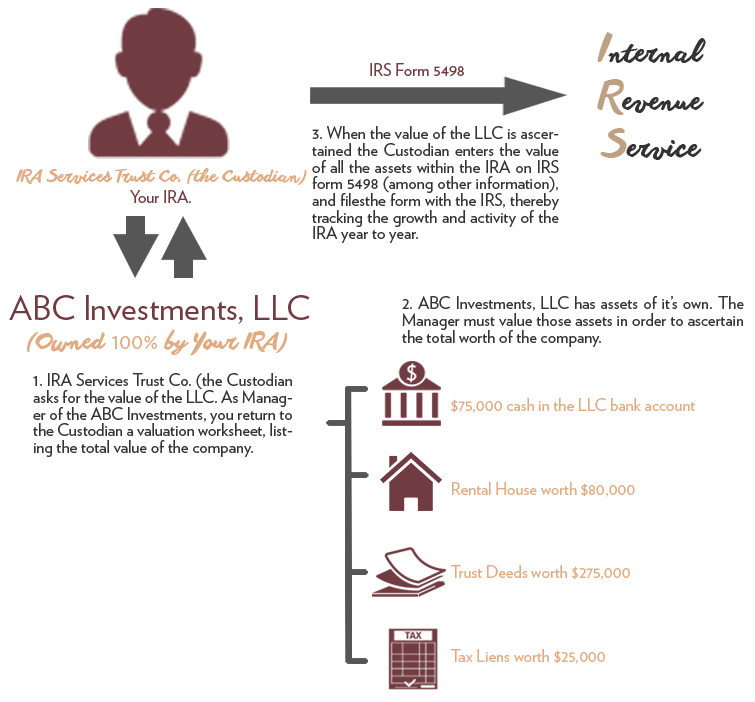

Irs Filing Requirements For Check Book Ira

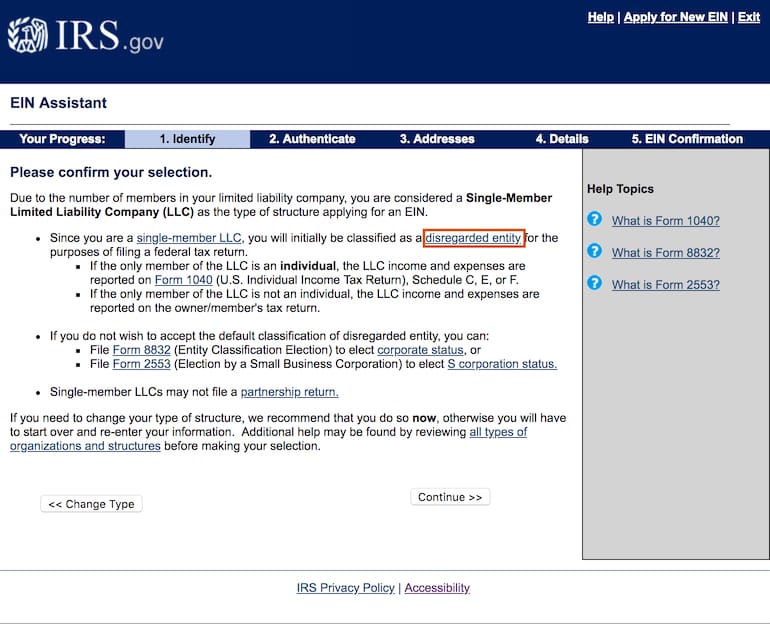

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

3 13 2 Bmf Account Numbers Internal Revenue Service

Pass Through Taxation What Small Business Owners Need To Know

How Should An Llc Fill Out A W 9 Form Correctly Ssn Vs Ein W9manager